This article offers insights derived from our scouting and mapping processes, where we collect a wide range of news, updates, events, opportunities, and other relevant topics related to the startup ecosystem.

As part of Startup Ecosystem Radar, we curate and condense this valuable information into a digestible format and offer it as a free monthly newsletter to our partners and clients. Our goal is to provide insights about the ecosystem, empowering informed business decisions and facilitating connections with relevant stakeholders. Don’t miss out on the latest updates – subscribe to our newsletter today!

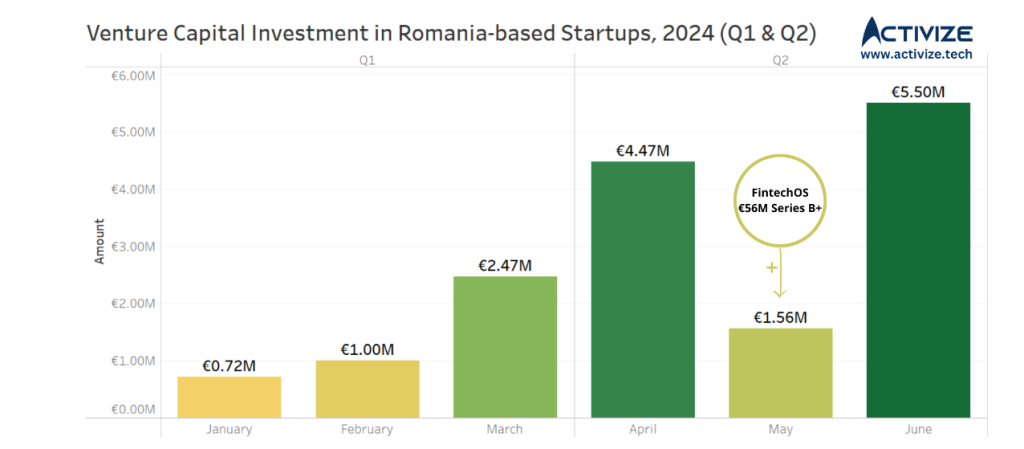

Based on public announcements, in the first half of 2024, we tracked 23 investment rounds in Romanian startups and 7 in foreign startups with at least one Romanian founder residing abroad.

The investment amount for this period reached approximately €71.7M across 23 rounds in domestic startups, while foreign startups with Romanian founders secured ~€28.74M across 6 investment rounds, and one round undisclosed in terms of transaction value.

It is important to note that the above analysis is highly impacted by FintechOS‘s significant $60M (~€56M) Series B+ investment. To provide more realistic predictions and conclusions, we have decided to address it as a distinct entity. Furthermore, in the following chart, we have separately included this investment round to better observe the monthly distribution of the invested capital.

Based on Crunchbase’s data, globally, the first quarter of 2024 experienced a notable decline in startup funding, reaching the second-lowest point since 2018. Although there was a slight 6% increase compared to the previous quarter, funding saw a significant 20% drop from the same period last year.

This pattern is also present here, at the local level. As depicted in the chart above, the first quarter for Romanian startups fell significantly short of the success seen in the same period last year (you can check out our article on analyzing the first half of 2023).

In comparison to the €38.1M (29 investment rounds) invested in Romanian startups during the first quarter of 2023 (excluding FlowX.AI’s $35M Series A investment round), this year experienced a substantial 60.1% decrease, with startups attracting just €15.72M (excluding FintechOS’s Series B+ investment) distributed across 22 investment rounds.

This trend underscores a more cautious stance among investors, who are now leaning slightly more towards safer perceived investments (especially from angel investors) or supporting existing investments with follow-ons with aim to protect their own portfolio (in case of some venture capital funds).

“There is a noticeable trend from especially the seed & series A VCs to not take the same amount of risk as before, but follow on and protect their own portfolio, as well as choose their bets wiser based on profitability, sustainability, break-even point and last consolidation of the current business model and client base. In our case at Startup Wise Guys and being the most active in the pre-seed stage, we choose to invest and accelerate and then follow on in the most resilient startups. Hence, 39% of our portfolio companies that we invested over 9 years ago are active while the overall market benchmarks point towards only 10% of the companies to be alive after 10 years. This above-average survival rate is evidence that accelerator-backed companies know how to overcome tough times if monitored closely and followed on at the right time.“Razvan Suta, CEE Business Development Lead @Startup Wise Guys

While not breaking record levels, it’s important to recognize the significant growth in the European (and also Romanian) startup funding landscape in the past 10 years. Based on Vestbee’s funding report, from 2014 to 2021, Europe’s venture capital ecosystem showed steady expansion, with funding levels more than doubling in 2021 alone. However, following a surge in 2021 and 2022, European VC investment reverted to pre-2021 levels, signaling a market cooling off due to a combination of factors.

“While the investment volume has slightly increased compared to the same period last year, we at TechAngels see fewer Romanian start-ups to choose from at the top of the funnel. As such, half of the 43 start-ups we have seen in pitching sessions in H1-2024 are foreign – albeit 6 have Romanian co-founders established abroad. FilmChain is one example of a foreign start-up founded by 2 Romanian entrepreneurs in the diaspora, who managed to attract funds from local business angels. We remain optimistic about the second half of the year: Q4 is typically when the investment activity picks up speed. We expect some companies in our angel’s portfolios to raise subsequent rounds – either Seed or Series A.”Marius Istrate, Chairman of the Board @TechAngels Romania.

Regarding the distribution of the investments received by the Romanian startups, we can group them by the following way:

- €829.5K in 9 rounds up to €200K (probably others investments were made at this stage, but these were not announced publicly)

- €2.57M in 7 rounds €200K to €1M

- €6.82M in 5 rounds €1M to €3M

- €5.5M in 1 round higher than €3M

- FintechOS’s $60M (~€56M) round

“This year at Fortech Investments, we have shifted our focus from investing in very early startups even without revenue to more mature start-ups, and we realized that deal flow for late seed in Romania was really limited, pushing us to make more investments in start-ups from abroad that we might have intended to. It seems there is a sense of disappointment in the Romanian start-up scene, with fewer entrepreneurial initiatives compared to previous years. This can be attributed to the limited funding options available last year, as most VCs were raising funds in Romania. However, we are optimistic that this trend may change in 2025, as there are new initiatives emerging to create more funding opportunities.”Irina Mișca, Investment Manager @Fortech Investments

Some of the highest and most important deals so far in 2024 were the following:

- FintechOS, a leading end-to-end financial product management platform from Romania, announced the successful completion of a $60M Series B+ investment round led by Molten Ventures, Cipio Partners, BlackRock and others (link).

- Genezio, a startup launched in 2023 to create tools to help developers automate app creation, raised a €1.87M ($2M) pre-seed round led by Gapminder Ventures. The investment was made together with Underline Ventures and a group of angel investors (link).

- Cluj-based startup Nordensa, which wants to democratize investing in football players, has received an pre-seed investment round worth €1.65M from a number of angel investors (independent and members of Transylvania Angels Network and Growceanu) (link).

- TOKERO, a cryptocurrency exchange, has announced the successful closing of its first private funding round of €1.3M ($1.4M) for the development of their own utility token, the TOKERO LevelUP Token (link).

- ELEC, the Romanian electric ride sharing platform, has attracted investment funds of over €1M to become an electromobility ecosystem (link).

We have to point out that beside these mentioned, there are a few other solid rounds which were not disclosed yet, included in the metrics above, but not named publicly.

In order to have access to the full list of investments as they appear, subscribe to Startup Ecosystem Radar.

Ranking in Eastern Europe

In the macro picture of the past years, in terms of rounds and volume, Invest Europe says that Romania is statistically in the mid-area within the Eastern European rankings, situated better than countries like Bulgaria or Slovakia, but behind others like Slovenia, Poland or Estonia.

While compared based on percent of GDP, private equity investments represent less than 0.03% of countries GDP, which ranks Romania, among the last ones in Europe.

Funding for foreign startups with Romanian founders

Regarding the funding raised by startups which have at least one Romanian co-founder, this totals ~28.74M in 6 deals. This represents nearly a halving compared to the same period in 2023, which totaled around €58.1M.

The biggest investments were the following:

- NY-based startup with Romanian roots, Ezra has received €19.6M ($21M) in an investment round led by Healthier Capital. The investment will be used for the improvement of its AI-powered full-body scans solution (link).

- Deltia.AI, a Berlin based startup that develops artificial intelligence technologies for factories, completed a €4.5M seed funding round led by Cavalry Ventures (link).

- FilmChain, the startup in the international film industry, founded by two Romanians, has completed an investment of €2.8M led by Holt InterXion, with the support of Roca X, DeBa Ventures, TechAngels Romania and HearstLab (link).

In order to have access in real time to this kind of information, join Startup Ecosystem Radar.

Closing

These statistics offer a snapshot of the first half of the year, with potential for further fluctuations throughout the full year compared to previous periods.

Despite ongoing challenges, optimism for the future remains strong, underscoring the need to stay alert and responsive to the evolving dynamics of the CEE region in the upcoming quarters.

Also check this other article that might be of interest, but focused on the Startup Programs and Events in Romania: A Comprehensive Overview (January-June 2024).

Look forward to our comprehensive year-end review of venture capital funding in Romanian startups for 2024. Stay updated on further insights and developments in the startup ecosystem by subscribing to our newsletters below!

Sursă articol: activize.tech